Most renters insurance policies do cover stuff in storage units, but there’s a catch. Coverage typically maxes out at 10% of total personal property limits—some states offer a flat $1,000 instead. Fire, theft, and vandalism are usually covered. Flooding and mold? Not so much. The policy deductible still applies, and some facilities demand proof of insurance before handing over keys. Keeping detailed inventories with photos and receipts makes the claims process less painful. Understanding the fine print reveals whether additional storage insurance is actually necessary.

Design Highlights

- Renters insurance typically covers storage unit contents up to 10% of total personal property coverage or $1,000 flat limit.

- Standard policies protect against fire, theft, vandalism, windstorms, and burst pipe water damage in storage units.

- Flooding, mold, mildew, and long-term moisture damage are excluded from typical renters insurance coverage.

- Storage facilities may require proof of insurance and often offer optional third-party coverage that could duplicate existing protection.

- Maintain detailed inventory lists with photos and receipts to expedite claims and verify actual cash value or replacement costs.

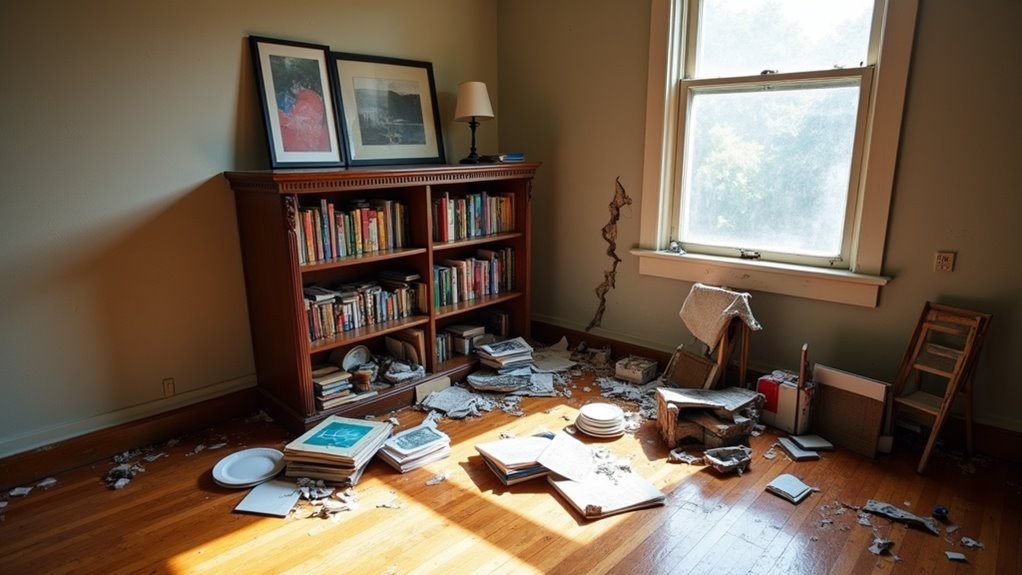

Most renters know their insurance covers stuff in their apartment. But what about that climate-controlled box across town stuffed with childhood memorabilia and half a garage worth of furniture? Turns out, renters insurance generally does cover personal property in storage units. Fire, theft, vandalism, weather damage—the usual suspects are typically included under Coverage C, the personal property section of a standard policy.

Renters insurance typically extends Coverage C protections to storage units, covering fire, theft, vandalism, and weather damage for off-site belongings.

There’s a catch, obviously. Coverage limits for off-premises storage are usually capped at about 10% of total personal property coverage. So if someone has $50,000 in coverage, they’re looking at maybe $5,000 for storage unit contents. Some states go with a flat $1,000 limit if the 10% doesn’t apply. California, New York, Connecticut, Virginia, and Florida offer whichever is higher—10% or $1,000. Still not exactly generous for anyone storing significant valuables.

Common covered perils include fire and smoke damage, theft, water damage from burst pipes, vandalism, and certain weather events like windstorms or hail. Flooding? Nope. Mold, mildew, long-term moisture damage? Also excluded. The policy deductible applies too, meaning out-of-pocket costs before the insurer pays anything.

Storage facilities themselves often require proof of insurance before handing over keys. They’ll usually offer optional third-party insurance as an add-on, which can get redundant fast. It’s worth checking requirements before signing a rental contract to avoid paying for duplicate coverage. If someone doesn’t have renters insurance, facilities might force them to buy standalone storage insurance anyway.

For those storing high-value items or facing coverage gaps, dedicated storage unit insurance exists. These policies can provide higher limits and broader protection than standard renters insurance sub-limits. Some storage-specific insurers cover unusual risks like rodent damage, vermin, mold, even sinkhole collapse or sonic booms. Yes, sonic booms. Renters insurance may also include liability coverage if someone accidentally damages the storage facility property itself.

Premiums, deductibles, and coverage scope vary wildly, so comparison shopping matters. Before filing a claim, policyholders should maintain detailed item-by-item lists with photos, receipts, and serial numbers to help insurance adjusters verify losses and expedite the claims process. Keeping receipts is particularly useful for additional verification when determining the actual cash value or replacement cost of damaged or stolen items.

Bottom line: renters insurance typically covers storage units, but within tight limits and with notable exclusions. Policyholders need to confirm their storage unit possessions are explicitly covered under their terms. The 10% rule or $1,000 cap might not cut it for expensive stored belongings. Self-storage insurance or dedicated storage policies can fill gaps when renters insurance falls short. No one wants to discover their coverage was insufficient after a theft or fire. Reading the fine print isn’t fun, but it beats getting blindsided by denied claims.

Frequently Asked Questions

What Happens if I Store Items at a Friend’s House Instead of a Storage Facility?

Renters insurance typically covers items stored at a friend’s house, treating them like stuff in a storage unit.

Same perils apply—theft, fire, vandalism. The catch? There’s usually a 10% sub-limit on off-premises coverage.

So if someone has $50,000 in personal property coverage, only $5,000 applies to items stored elsewhere.

Deductibles still kick in.

Documentation matters for claims—receipts, photos, inventory lists. The insurer might even want a statement from the friend confirming the arrangement.

Does Renters Insurance Cover Items Stolen From My Car Parked at the Storage Unit?

Yes, renters insurance typically covers personal belongings stolen from a car parked at a storage unit.

It’s treated like any other off-premises theft. But here’s the catch: the policy’s deductible applies, and there are coverage limits. High-value items like jewelry or electronics might hit sub-limits fast.

The car itself? Not covered—that’s what auto insurance is for. A police report is required to file a claim, along with receipts or proof of what got stolen.

Are Collectibles and Antiques Covered at Full Value in Storage Units?

No, collectibles and antiques typically aren’t covered at full value in storage units under standard renters insurance.

They hit special sub-limits—often way lower than actual worth. Want full coverage? A scheduled property endorsement or rider is necessary.

These require listing specific items with appraised values, guaranteeing proper reimbursement. Without one, claims get capped at inadequate base coverage amounts.

Most policies also slap on deductibles and exclude perils like flooding or mold.

Bottom line: standard coverage falls embarrassingly short for valuables.

Can I Add My Roommate’s Belongings to My Renters Insurance Storage Coverage?

No, a policyholder can’t add their roommate’s belongings to their renters insurance storage coverage.

Standard policies only cover the named insured’s property—that’s it. The roommate needs their own separate policy to protect their stuff in storage. Period.

Storage sub-limits (usually 10% of coverage or $1,000) apply only to the policyholder’s items.

Trying to claim a roommate’s belongings under someone else’s policy? That’s a quick path to claim denial. Each person needs independent coverage.

Does Coverage Apply if the Storage Unit Company Goes Out of Business?

The search results don’t say squat about what happens if a storage company goes belly-up.

That specific scenario just isn’t covered in the available information.

Here’s the thing though: renters insurance covers the *stuff*, not the facility itself.

So theoretically, if items get stolen or damaged during a facility closure, coverage might still apply.

But the actual mechanics? That requires calling the insurance provider directly.

No clear answer exists here.