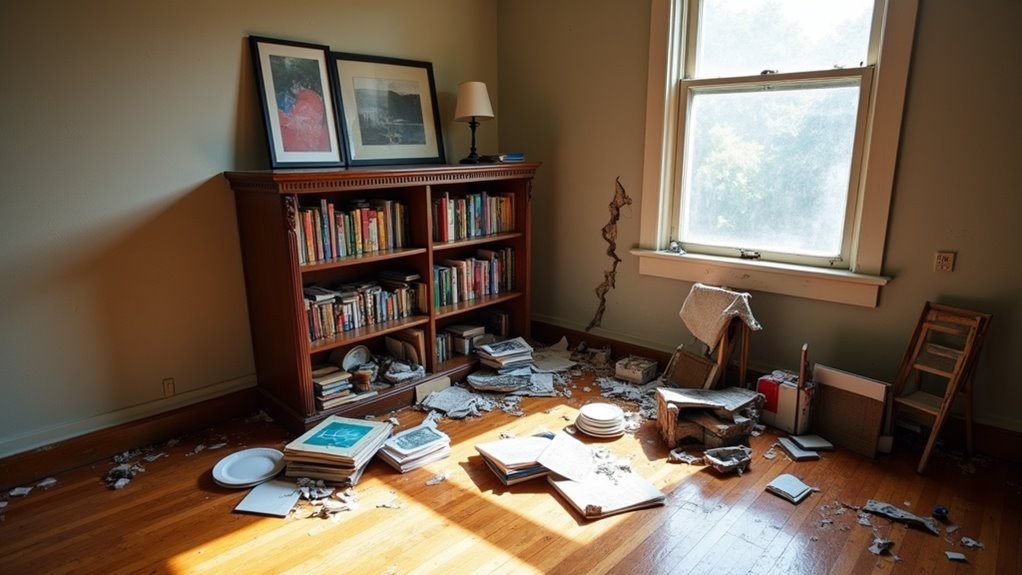

Standard renters insurance doesn’t cover earthquakes. Period. Basic policies explicitly exclude earthquake damage under “earth movement” clauses, meaning belongings destroyed by seismic activity won’t be reimbursed. Renters need separate earthquake insurance—either as an endorsement to existing policies or a stand-alone policy—to protect personal property. Coverage can start as low as $35 annually and typically includes repair costs, replacement of destroyed items, and additional living expenses if the rental becomes uninhabitable. Geographic location matters greatly, with high-risk states like California often requiring specialized policies to guarantee adequate protection.

Design Highlights

- Standard renters insurance excludes earthquake damage under “earth movement” exclusions and does not cover belongings destroyed by earthquakes.

- Separate earthquake insurance or endorsements specifically cover personal property damaged or destroyed by earthquakes.

- Earthquake policies also cover additional living expenses if your rental becomes uninhabitable after an earthquake.

- Coverage can be added to existing renters insurance or purchased as a stand-alone policy, starting around $35 annually.

- Renters in earthquake-prone areas like California and the Pacific Northwest are strongly encouraged to obtain specialized coverage.

When it comes to protecting their stuff from natural disasters, most renters are in for an unpleasant surprise. Standard renters insurance doesn’t cover earthquakes. Not even close. Earthquakes fall under something called “earth movement” exclusions, which also includes landslides and sinkholes. So when the ground starts shaking and belongings get destroyed, that basic policy isn’t going to reimburse anything.

Even loss of use or additional living expenses stemming from earthquake damage typically require separate coverage. Some exceptions exist—certain military-focused insurers like USAA may include earthquake coverage—but renters need to verify policy details carefully because assuming coverage exists is a costly mistake.

Don’t assume you’re covered—even temporary housing costs after earthquake damage usually need separate insurance policies.

The good news is that earthquake insurance for renters actually exists. It covers personal property damaged by earthquakes, including aftershocks and related earth movements. Policies typically pay for repair or replacement of belongings destroyed during a quake. Many also cover additional living expenses if the rental becomes uninhabitable afterward.

Some policies even include emergency repairs up to a certain limit, like $1,000, to prevent further damage after the shaking stops. But there’s a catch. Policies often have separate deductibles specific to earthquake claims that differ from standard renters insurance deductibles.

Renters can add earthquake coverage as an endorsement to existing insurance or purchase it as a stand-alone policy. In high-risk states like California, separate earthquake policies are common and often necessary. State programs like the California Earthquake Authority offer renters earthquake insurance with premiums starting as low as $35 per year.

That’s surprisingly affordable considering the potential damage costs. Getting coverage means contacting a current insurer or purchasing through state-backed programs. Shopping around and comparing quotes is recommended.

But earthquake insurance has limitations. It generally excludes damages caused by flooding or tsunami-related water damage, even if an earthquake triggered them. Structural damage to the rental building itself is the landlord’s problem, not covered by renters’ earthquake insurance.

Damage from earth movements not classified as earthquakes, like sinkholes unrelated to seismic activity, may also be excluded. Temporary lodging costs might be covered, but specific policy limits and conditions vary widely. Coverage limits often have maximum payout caps depending on the policy. Deductibles range from 5% to 25% of the coverage amount, which means renters pay a significant portion out of pocket before insurance kicks in.

Geographic location matters. Renters in earthquake-prone regions like California and the Pacific Northwest are strongly encouraged to purchase earthquake insurance due to higher risk. California sees a high frequency of earthquakes, making specialized coverage critical for renters in the state. Areas with little earthquake history may allow adding coverage as endorsements rather than requiring separate policies.

Either way, standard renters insurance won’t cover the shaking.

Frequently Asked Questions

How Much Does Earthquake Insurance for Renters Typically Cost per Month?

Earthquake insurance for renters typically runs $3 to $5 per month in high-risk areas like California.

Outside earthquake hotspots, it’s even cheaper—sometimes under $3 monthly.

East Coast renters often pay less than $300 annually, which breaks down to roughly $25 per month or less.

The cost depends on coverage amount, deductible choice, and proximity to fault lines.

Bottom line: it’s considerably cheaper than homeowner policies since renters only cover personal belongings and temporary housing, not the building structure itself.

Can I Buy Earthquake Coverage Separately From My Renters Insurance Policy?

Yes, renters can buy earthquake coverage separately if their current insurer doesn’t offer an endorsement.

Stand-alone earthquake insurance policies exist specifically for this purpose. The California Earthquake Authority is a major provider, especially in high-risk states.

These separate policies cover personal property and additional living expenses caused by earthquakes. It’s a straightforward alternative when endorsements aren’t available.

Renters should compare quotes from multiple providers to find coverage that actually meets their needs without overpaying.

What Is the Typical Deductible for Earthquake Insurance for Renters?

Earthquake insurance for renters doesn’t use flat dollar deductibles. It’s percentage-based, calculated from the total coverage limit.

Most policies offer 5% to 25% deductibles. So a 10% deductible on $25,000 coverage means paying $2,500 out-of-pocket first. Higher-risk areas often require higher minimums. Lower deductibles mean pricier premiums, obviously.

The sweet spot? Most renters land somewhere between 10% and 15%, balancing affordability with manageable out-of-pocket costs.

Are Aftershocks Covered Under Earthquake Insurance for Renters?

Yes, aftershocks are covered under earthquake insurance for renters.

Most policies treat them as part of the same claim as the main quake—pretty convenient, actually.

There’s a catch, though: the aftershocks must happen within 360 hours (that’s 15 days) of the initial earthquake.

Miss that window? You might need a separate claim.

The same deductible applies to everything, so at least you’re not getting hit with multiple deductibles.

Damage to personal property and additional living expenses are included.

Does Earthquake Insurance Cover Temporary Housing if My Rental Becomes Uninhabitable?

Yes, earthquake insurance typically covers temporary housing through Additional Living Expenses (ALE) or Loss of Use coverage when the rental becomes uninhabitable.

This means hotel stays, meals, and related displacement costs get reimbursed. But here’s the catch—standard renters insurance doesn’t include this. It must be added specifically as earthquake coverage.

The rental has to be officially declared uninhabitable, and there are coverage limits and time restrictions. Renters need to save receipts and document everything for claims.