🚘 Car Insurance Rates in Michigan for 2025

Michigan continues to have some of the highest car insurance rates in the country, even after the 2020 auto insurance reform. Detroit remains the most expensive city in the United States for auto insurance due to high claim frequency, fraud, and medical costs.

In this guide, we break down the average cost of car insurance in Michigan for 2025, the cheapest companies, and how drivers can save under the new PIP and coverage rules.

🚗 Average Car Insurance Rates in Michigan (2025)

Michigan has historically been the #1 most expensive state for auto insurance due to:

- Unlimited PIP (medical) coverage

- High medical claim costs

- Detroit metro accident frequency

- Higher fraud rates

- Expensive litigation

Although the 2020 reforms lowered costs for many drivers, prices remain elevated.

📌 Michigan Average Annual Premium:

$3,000+ per year (Full Coverage)

This is the highest in the U.S., often double or triple nearby states like Ohio and Indiana.

💸 Cheapest Car Insurance Companies in Michigan

Michigan has a competitive market, but prices vary heavily based on ZIP code, PIP limits, and driving history.

These companies usually offer the best rates:

1. Progressive

Strong for Detroit-area drivers and high-risk profiles.

2. GEICO

Competitive for drivers outside metro Detroit.

3. State Farm

Good for safe drivers and homeowners.

4. Allstate

Higher base premiums, but strong bundling discounts.

5. USAA

Cheapest for military families.

Note: Detroit ZIP codes often see rates 200–300% higher than the rest of Michigan.

⚠️ Michigan’s Unique Auto Insurance Laws (What Makes It Expensive)

Michigan’s insurance system is different from that of any other state.

1. No-Fault Insurance System

Drivers turn to their own insurance for injury claims, regardless of fault.

2. Personal Injury Protection (PIP) Levels

Before 2020, unlimited PIP was mandatory, driving costs through the roof.

Now, drivers can choose:

- Unlimited PIP

- $500,000 PIP

- $250,000 PIP

- $50,000 PIP (Medicaid only)

- PIP Opt-Out (Medicare only)

Lower PIP = Lower premiums.

3. High Medical Costs

Michigan’s medical reimbursement rates have historically been extremely high.

4. Fraud & Litigation

Detroit and surrounding counties see elevated fraudulent claims.

5. High Accident Frequency

Metro Detroit has some of the highest crash rates in the U.S.

🛠️ How to Save on Car Insurance in Michigan (2025)

Drivers can significantly reduce premiums with the following strategies:

✔ 1. Adjust Your PIP Level

Choosing $250k or $500k PIP instead of unlimited can save thousands.

✔ 2. Bundle With Homeowners or Renters Insurance

Almost always lowers costs in Michigan.

✔ 3. Increase Deductibles

Collision and comprehensive deductibles drastically affect pricing.

✔ 4. Install Anti-Theft Devices

High theft areas (Detroit, Flint) get major reductions.

✔ 5. Use Telematics Programs

State Farm, Progressive, and Allstate offer usage-based discounts.

✔ 6. Maintain a Good Credit Score

Michigan allows credit-based insurance scores.

✔ 7. Shop Insurance Every 6–12 Months

Michigan rates fluctuate more than most states — switching can save a LOT.

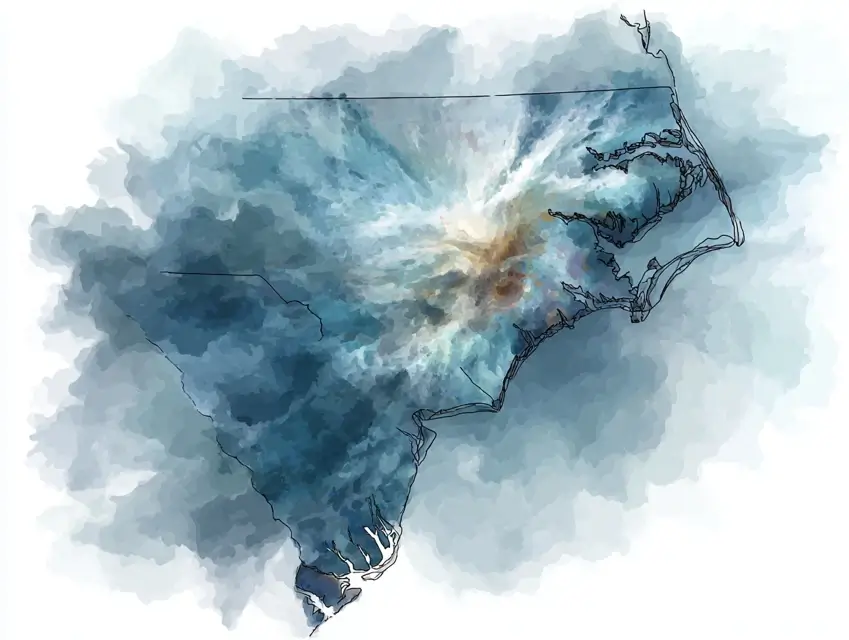

📍 Michigan Cities With the Highest Premiums

Rates vary extremely by ZIP code.

Most expensive areas:

- Detroit

- Dearborn

- Southfield

- Flint

- Warren

More affordable areas:

- Grand Rapids

- Ann Arbor

- Holland

- Kalamazoo

- Lansing

Detroit drivers often pay 3–5 times more than those in western or northern Michigan.

🔗 Related Articles

- Georgia Car Insurance Rates (2024)

- California Car Insurance Rates (2024)

- New York Car Insurance Rates (2024)

- Auto Insurance Market Share (2024)

- Loss Ratio Comparison (2024)

- Claims Processing Speed Chart

- Combined Ratio Trend

❓ FAQ – Car Insurance in Michigan (2025)

1. What is the average cost of car insurance in Michigan?

Over $3,000 per year, the highest in the U.S.

2. Who offers the cheapest car insurance in Michigan?

Progressive, GEICO, State Farm, and USAA are the cheapest for military.

3. Does Michigan still require unlimited PIP?

No. Unlimited PIP is optional since the 2020 reform.

4. Why are Detroit car insurance rates so high?

Accidents, theft, fraud, medical costs, and litigation.

5. Is Michigan still a no-fault state?

Yes, Michigan remains a no-fault insurance state.